Insurance companies are as popular as banks but life would otherwise be difficult. Without insurance, we would have no option but to carry the full cost of a catastrophic event (house burning down, car getting nicked) on our own. This is okay if we’re really rich, poor or lucky, but not so good the rest of the time.

First published in the April 2008 issue of Street Machine

Instead, insurance allows us to share the risk of something bad happening with other people, by each paying a premium into a much larger pool of money, out of which those poor buggers who do suffer a big loss are reimbursed.

Premiums are set according to the expected outgoings from the fund – how many cars in total are likely to get nicked – and individual risk: how much more likely is it your car will get nicked compared with, say, your mum’s Corolla. The value of your car can also be a factor.

Complaints about insurance companies usually centre on the exorbitant cost of the premiums, or the shortfall between actual and expected payouts when something does go wrong.

Insurance companies aren’t charities but if they get greedy and overcharge on premiums, their customers will go elsewhere, just like any other business. Well, that’s the theory and it’s the practice too if we shop around and compare prices, which these days is as easy as typing ‘car insurance quotes’ into Google.

Insurance companies increasingly specialise in market segments and some may not particularly want your business, in which case they’ll quote an uncompetitive premium. This is especially the case for younger drivers and older cars, which is why specialist insurers like Shannons and Ryno were made for people like us.

If the premiums are too low, the insurance company will get a lot of business but will eventually go belly-up when the claims exceed premium income. This is what happened to HIH Insurance, and it caused enormous hardship to a lot of people whose valid claims could no longer be met.

When setting individual premiums, insurers assess risk by reviewing claims made in the past. The key determinants that insurance companies have found useful in predicting future claims are the make and model of the vehicle; its age; business or private use; locality; driver age and record; car finance; modifications; and previous insurance history. Occupation, anti-theft devices and number of kilometres travelled may also be relevant.

Insurers reward loyalty and good claims records with ‘no-claim bonuses’, which can reduce your premiums by up to 65 per cent. Typically, a discount of 20 per cent is offered on comprehensive insurance after one year, then 10 per cent per year after that. In many cases, these no-claims bonuses are transferable, and further discounts may be available from specialist insurers for multiple cars.

Premiums are also affected by how much ‘excess’ you are prepared to pay: a standard policy may require you to pay for the first $1000 worth of damage, which you can reduce by paying a higher premium. Vehicles with notoriously high theft histories typically have very high excesses, as do young drivers.

Most disputes arise when there are shortfalls in expected payments, or claims are refused entirely; the devil is often in the detail, so it always pays to read the fine print. In 60 per cent of complaints, people think they are insured for a particular event and find they are not – third party insurance is a classic example – so let’s take a look at the broad types of car insurance on offer and what they cover.

Compulsory Third Party

This insurance (sometimes called a green slip) protects you for claims for injury or death your car might cause to another person, assuming you or any other driver of your car was at fault.

It is compulsory to the extent you won’t get your car registered without it. In some states it’s bundled in with car registration fees but usually you can shop around for the best price. Premiums are not related to the value of the car, but rather to the age of the driver and car, and whether the car is covered by other insurance.

What CTP doesn’t cover you for is damage you might cause to another person’s car or property, nor does it cover injury to you or damage to your own car.

Third Party property Damage

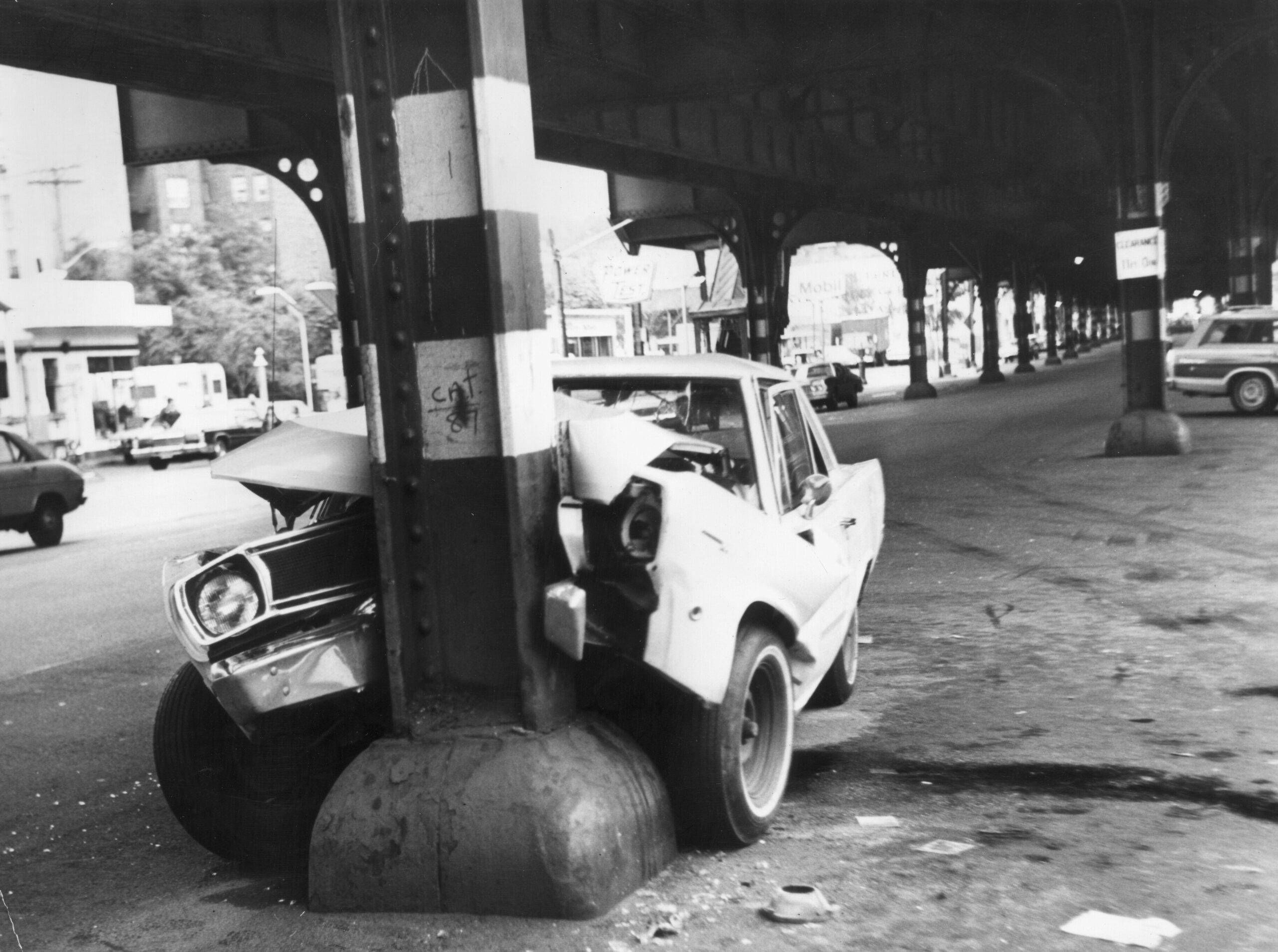

TPPD insurance protects you for claims for damage your car may cause to another person’s car or property. If you crash into another car (or house, or traffic pole) and you are at fault, then you are liable for the damage caused.

Without TPPD, even a minor bingle with an expensive car could send you to the poorhouse. We strongly recommend young drivers at least take out TPPD, with the added advantage that a good TPPD record could set you up for a handy no-claim bonus when you later upgrade to comprehensive insurance (check with your insurer).

What TPPD doesn’t cover is damage to your own car, even if the other driver is at fault. Some companies offer a limited exception to this if the driver of the car at fault is uninsured.

Third party Property, fire & theft

This offers the protection of TPPD cover (above), but also covers you should your car be stolen, or written off after a fire. It is not offered by all insurance companies but is often cost-effective for younger drivers who have some money invested in their cars but can’t afford comprehensive insurance.

Comprehensive

Comprehensive is as the name suggests: it covers you for damage to your own car, as well as damage you may cause to someone else’s car or property. It also covers fire and theft but not personal injuries or death.

It’s the dearest form of car insurance and can be very expensive for people with less than five years driving experience, but if you have finance on your car, the lender will most likely require you have it regardless.

This is where you will find the biggest variations in premiums, so it’s most important you shop around. Policy details may also vary on things like covering the cost of tow trucks, accommodation if you crash far from home, replacement cars and choice of repairer.

Agreed vs market value

When you insure your car comprehensively, it will be at either market value or agreed value. The former is more common: if your car is written off, you will be paid out the current average market value for that make and model.

This can sometimes come as a rude shock as some cars depreciate very quickly. Ditto if you own a particularly good example of an older car, as the insurer will just lump it in with all the rusty dungers. Better in this case to insure it for an agreed value with a specialist insurer; they will ask for photos and lots of other information, and then negotiate with you for an agreed value.

It might not match what you’ve spent but it will be higher than market value. Agreed value policies often also have a provision that allows you to retain the wreck in the event of a write-off.

Limited usage/laid-up cover

Specialist insurers acknowledge that some cars do very few road miles: off-street drag cars, vintage cars, show cars, hot rods, even thirsty family cruisers. If you use your car infrequently, the premiums can be reduced dramatically.

These same insurers can also insure your unfinished project, to protect you against a shed fire or theft during the build.

Exclusions

If you do not disclose relevant information when you take out the policy, the insurer may not pay your claim, so there’s no point in fudging or telling fibs. It’s also important that you notify the insurer if the car is modified after taking out insurance, and that you tell the whole truth when making your claim; if you don’t, not only might your claim be rejected but you could be charged with fraud too.

Nor will the insurer pay you out if you or any other driver of your car was driving under the influence of alcohol or drugs.

Comments